Buying your first home is a thrilling experience, but it can also be nerve-wracking, especially in Nepal’s dynamic real estate market. With excitement comes the potential for costly mistakes. Here, we’ll look at the top five mistakes first-time home buyers make in Nepal and how to sidestep them. Let’s help you make your journey to homeownership smooth and successful!

1. Skipping Pre-Approval for a Home Loan

One of the most common mistakes is not getting pre-approved for a home loan before starting the search. In Nepal, where real estate transactions often require swift decisions, having pre-approval gives you a clear idea of your budget. Without it, you risk falling in love with a house you can’t afford.

How to Avoid It:

Visit a few banks and financial institutions to get pre-approved. This process evaluates your financial standing and gives you an estimate of the mortgage amount you qualify for. With a pre-approval letter in hand, you have an edge when negotiating and can focus on homes within your budget.

2. Neglecting Property Inspection

Skipping a thorough property inspection is a mistake many first-time buyers make in Nepal. Whether it’s an old home or a new build, there could be underlying issues like structural damage, plumbing problems, or faulty electrical systems.

How to Avoid It:

Hire a professional inspector to evaluate the property before making any commitments. Spending a few thousand rupees on an inspection could save you from unforeseen repair costs down the road. This is especially important if you are buying in areas prone to earthquakes or landslides.

3. Ignoring Hidden Costs and Fees

Most first-time home buyers focus solely on the sale price without considering additional costs. In Nepal, there are several extra expenses, including property registration fees, legal fees, maintenance charges, and taxes.

How to Avoid It:

Create a detailed budget that includes not just the down payment but also the associated costs of purchasing a home. Talk to your real estate agent or a financial advisor to understand the full spectrum of costs involved. This will help you avoid unpleasant surprises after the purchase.

4. Choosing the Wrong Location

Location is everything in real estate, yet many first-time buyers prioritize the property over its location. In Nepal, factors like access to public transportation, proximity to schools, and safety are crucial in determining the long-term value of your investment.

How to Avoid It:

Conduct thorough research on neighborhoods that align with your lifestyle and needs. Use platforms like Google Maps, and visit the area at different times of the day to get a feel for traffic, noise levels, and safety. Consider future developments in the area as they can impact property values.

5. Failing to Work with a Real Estate Professional

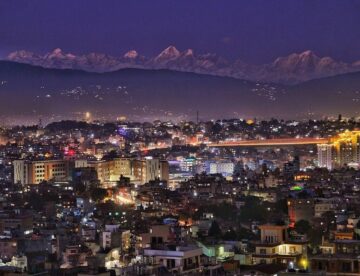

Many first-time buyers attempt to navigate the real estate market alone, thinking it will save them money. However, the complexities of buying a house in Nepal, especially in high-demand areas like Kathmandu and Pokhara, can be overwhelming without professional guidance.

How to Avoid It:

Partner with a reputable real estate agent who knows the local market. They can provide valuable insights, help with negotiations, and guide you through the legal process. This support can prevent costly mistakes and ensure a smoother transaction.

Conclusion

Purchasing your first home in Nepal is a major milestone, but it’s essential to avoid these common mistakes. By getting pre-approved, inspecting the property, budgeting for hidden costs, prioritizing location, and working with a real estate professional, you can make a more informed decision and secure your dream home.

Ready to start your home-buying journey? Explore our latest listings and get personalized guidance from our experienced real estate team.

Continue reading: Why Smart Investments in Nepal’s Suburban Areas Are on the Rise