Real estate market cycles are an essential aspect of property investment, and understanding these cycles can help homebuyers in Nepal make more informed decisions. Whether you’re purchasing property for personal use or as an investment, knowing when to buy is a key factor in maximizing returns. Here’s a guide to the real estate market cycles in Nepal and how to use them to your advantage.

1. What Are Real Estate Market Cycles?

Real estate market cycles are phases that property markets go through, including periods of growth, stability, and decline. These cycles impact property values, demand, and supply. Typically, market cycles have four phases: recovery, expansion, hyper-supply, and recession. Understanding these cycles in the context of Nepal’s real estate market can help you identify the right time to buy, based on the market’s current phase.

2. Key Phases in Nepal’s Real Estate Market

In Nepal, the real estate market often follows the broader economic conditions. Here’s a breakdown of the typical phases:

- Recovery: Following a downturn, the recovery phase sees low demand and stable or slowly increasing prices. This phase is ideal for buyers who want to invest early at lower prices.

- Expansion: As demand increases, property prices begin to rise. This phase often coincides with economic growth, making it attractive for both buyers and investors looking for properties in emerging locations.

- Hyper-Supply: In this phase, property supply exceeds demand, leading to price stabilization or slight declines. Buyers should be cautious, as this phase might indicate an upcoming market slowdown.

- Recession: Prices fall as demand wanes, usually following an oversupply phase. This period may offer lower prices, but it’s important to evaluate whether the downturn is temporary or long-term.

3. Current Market Trends in Nepal

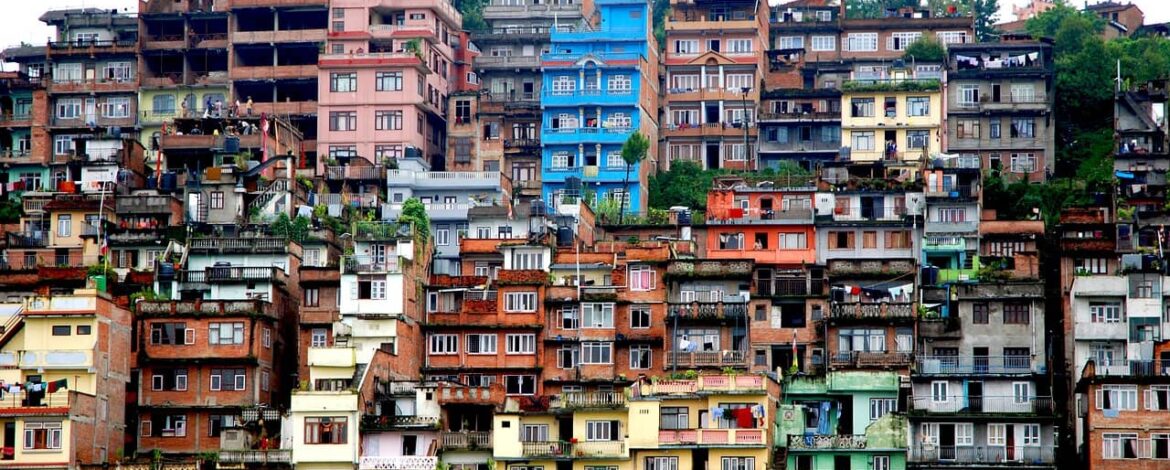

Nepal’s real estate market has witnessed significant changes in recent years, especially post-pandemic. Key urban areas like Kathmandu, Lalitpur, and Pokhara have seen steady growth as infrastructure improves and more people move toward city living. With the growing demand for urban housing, especially in well-connected areas, the market in these regions is often in the expansion phase. However, rural or less-developed areas may still be in a recovery phase, offering opportunities for early investors.

4. Identifying the Right Time to Buy

Knowing the right phase to enter the market depends on your financial goals. If you’re looking for long-term appreciation, buying during the recovery or early expansion phase can maximize your investment. For those seeking immediate stability, the expansion phase is often the best time. To time your purchase effectively, monitor key indicators such as changes in property prices, vacancy rates, and new construction projects in your desired area.

5. Economic Factors Affecting Nepal’s Real Estate Cycles

Economic conditions such as interest rates, inflation, and government policies can significantly impact real estate cycles. For example, lower interest rates can boost demand, pushing the market toward expansion. Similarly, policies favoring foreign investment can lead to increased property demand. By keeping an eye on these broader economic indicators, you can better predict market shifts.

Conclusion

Navigating Nepal’s real estate market cycles can provide valuable insights into when to buy property. By understanding the market’s current phase and considering economic factors, you can make a strategic investment that aligns with your financial goals. Whether you’re buying a family home or an investment property, timing your purchase effectively can enhance the value and security of your investment in Nepal’s dynamic real estate market.

Recommended reading: A Day in the Life at Karyabinayak Homes: Experience Modern Living in Bhaisepati