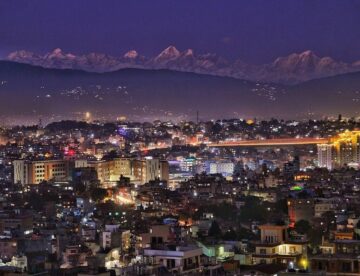

The Kathmandu Valley has become a prime location for real estate investment in Nepal, offering a mix of cultural heritage, urban convenience, and modern amenities. However, buying property here can be a major decision that requires careful consideration. This guide breaks down essential factors every homebuyer should evaluate to ensure a wise investment.

1. Location and Neighborhood

The location of a property is arguably the most crucial factor in determining its value and suitability. When purchasing a property in Kathmandu Valley, look for proximity to essential services like hospitals, schools, public transportation, and markets. Popular areas like Bhaisepati, Sanepa, and Lazimpat are highly sought after for their accessibility and vibrant communities. However, emerging neighborhoods on the outskirts of Kathmandu can offer quieter environments and long-term investment potential.

2. Future Development Potential

A property’s value often depends on future development in the surrounding area. Infrastructure projects like new roads, shopping complexes, schools, and hospitals can significantly increase property values over time. To assess this, research municipal plans and ongoing projects in the area where you’re interested in buying. Areas undergoing positive development are likely to see higher property appreciation, making them an ideal choice for future growth.

3. Property Condition and Construction Quality

The condition of the property, particularly in older buildings, can impact its overall value and maintenance costs. It’s essential to inspect structural elements, such as walls, roofs, and flooring, for any signs of wear or damage. If possible, consider a professional inspection to detect any hidden issues. Additionally, check the developer’s reputation for newer constructions, as established developers in Kathmandu are more likely to adhere to quality standards and use durable materials.

4. Legal Documentation and Title Verification

Legal verification is a critical step in property purchase. Ensure the property has a clear title deed, and verify that it’s free from any legal disputes or encumbrances. Consulting with a lawyer can provide peace of mind by confirming all necessary permits, including land registration and construction approvals, have been obtained. A clean legal history protects you from future legal issues and helps secure your investment.

5. Available Amenities and Utilities

Amenities such as parking spaces, gardens, and recreational areas add significant value to a property. Consider what amenities are essential to your lifestyle. Additionally, make sure utilities like electricity, water, and waste management are reliable. For families, factors like access to public transportation, nearby schools, and parks can make a property more convenient and livable.

6. Potential for Rental Income

If you’re considering a property for rental purposes, evaluate its rental income potential. Kathmandu Valley, especially areas like Thamel, Sanepa, and Jhamsikhel, attracts tenants due to its vibrant lifestyle and convenient access to amenities. Calculate potential rental income and consider occupancy rates in the area, as this can greatly impact your returns on investment.

7. Natural Disaster Preparedness

Nepal is prone to earthquakes, making it vital to assess a property’s disaster resilience. Properties built with modern earthquake-resistant designs provide added safety. Verify whether the property meets Nepal’s seismic safety standards, as this can influence both your personal safety and property value.

Conclusion

Buying a property in Kathmandu Valley can be an exciting and rewarding journey when approached with the right considerations. By evaluating the location, construction quality, legal documentation, and long-term potential, you can make an informed decision that aligns with your financial and personal goals. A well-chosen property in Kathmandu Valley is not just a home—it’s a valuable asset for the future.

Recommended reading: A Day in the Life at Karyabinayak Homes: Experience Modern Living in Bhaisepati