The past few years have reshaped Nepal’s housing market. Rapid urbanization, rising construction costs, and renewed investor interest have pushed property prices across the Kathmandu Valley and other urban centres.

In 2025, many buyers and first-timers are asking: how has colony property inflation shaped the market, what are realistic price expectations, and what should first-time buyers do now? This long-form guide answers those questions with data, analysis, tables, and practical steps tailored to Nepal.

Quick snapshot — headline takeaways

- Real estate prices in many urban pockets have risen faster than general consumer inflation; in 2025 some localized price increases in urban areas are reported in the double digits.

- Kathmandu Metropolitan City updated official land valuation for FY 2025/26 in July 2025, prime plots along key roads are now valued up to NPR 5 million per aana, reflecting official recognition of rising land rates.

- Construction-cost pressure (materials and labor) continues to push built prices higher; average construction costs per sq. ft. range widely depending on finishes but are notably higher than pre-pandemic levels.

- For first-time buyers, timing, financing, and micro-location matter most central city colony projects offer convenience and appreciation potential but can require more capital up front.

What “colony property inflation” means in the Nepalese context

“Colony” in Nepal often refers to planned residential developments, gated communities, or clusters of housing (including villas, townhouses, and plotted developments). Colony property inflation refers to the rate at which prices for units or plots inside such developments rise over time.

In Nepal, colony property inflation diverges from headline CPI for a few reasons:

- Land scarcity in central urban nodes — limited supply and high demand push land prices up faster than general inflation.

- Remittance flows and NRN investments — foreign remittances and NRN buying power can increase demand for safe, centrally located housing.

- Construction cost inflation — cement, steel, labor, and imported finishes have become pricier, increasing per-unit build costs and selling prices.

Consequently, colony prices (especially in premium or convenience-driven locations) have seen sustained growth in recent years, with micro-markets varying substantially.

2025 price trends — what the data shows

In 2025, colony and general property inflation in Nepal are driven by a web of forces: land revaluations, material cost inflation, speculative demand, and shifting buyer preferences. Let’s dig deeper into the numbers and patterns that are shaping the market now.

Land Valuation Adjustments: The KMC Land Rate Fixing

One of the strongest signals to price inflation is the official land valuation update by Kathmandu Metropolitan City (KMC) for fiscal year 2025/26. In July 2025, KMC fixed the land value for prime plots along major roads and key urban stretches at Rs 5 million per aana.

That means areas like New Road, Durbar Marg, Putalisadak, Ratnapark, and Singha Durbar are now formally recognized by municipal valuation at this high rate.

This official upward revaluation has two crucial effects:

- It raises the “floor” or baseline for plot cost, pushing colony developers to price their land parcels accordingly.

- It signals to buyers and investors that the government recognizes the rise in urban land valuation — which legitimizes higher asking prices in the private market.

In areas outside prime roads, KMC set slightly lower valuations (for example, Rs 4 million per anna in certain segments right of main roads).

This move has effectively baked in a substantial cost escalation for any new colony or plotted project, especially in central zones.

Property Price Inflation vs. General Inflation

According to market analysts and real estate portals:

- Real estate prices in urban Nepal are rising at 15–25% per year in many neighborhoods, outpacing general consumer inflation (which hovers between 6–8%).

- Land prices are often growing at 8–12% annually in many developing zones, though premium parcels (in central areas) can exceed that.

- Some reports mention that demand for luxury and high-end segments is especially strong in 2025, further inflating top-tier prices.

This gap colony/property inflation outpacing baseline CPI indicates that real estate is not just following inflation but gaining a speculative and scarcity premium.

Construction Material Inflation

Another major driver is input cost inflation. Recent data from Nepal shows:

- In July–August 2025, construction materials registered a 4.08% year-on-year increase in the Wholesale Price Index (WPI).

- The rise was especially strong in non-metallic minerals (cement, tiles, bricks), which saw ~16.73% growth; basic metals (steel, iron) were up ~9.54% year-on-year.

- Raw material prices: Cement, steel and aggregates have become more expensive because of global commodity pressure and local logistics.

- Imported finishes: Demand for imported tiles, sanitary ware, and modular kitchens pushes finished-unit prices up.

- Labor costs: Skilled labor shortages and wage pressure increase build timelines and costs.

- Regulatory compliance: Seismic safety and NBC standards can add cost for proper RCC construction and foundations.

Because colonies and plotted projects tend to depend more heavily on external material inputs (roadwork, landscaping, utilities), those cost escalations get passed to buyers more directly than for simple building-only projects.

Real Estate Market Sentiment & Transaction Volume

Data from real estate industry commentary adds nuance to the headline inflation:

- PropNepal notes that real estate inflation is materially above general inflation in many urban pockets, driven by land supply constraints, remittances, and speculative buying.

- In PropNepal’s trend analysis, rising property prices, surge in apartment demand, and shifts toward sustainable housing are key ongoing themes.

- Blog HouseLand describes 2025 as a year of intense competition for premium units and plots, particularly in areas connected to infrastructure and amenities.

- Some reports, however, warn of caution: high interest rates or liquidity constraints could slow transaction volume, even if asking prices continue to rise.

Micro-location Effects — Not All Areas Inflate Alike

While the overall trend is upward, inflation is uneven. Some patterns:

- Core corridors (e.g. main roads, heritage zones, areas with major infrastructure access) see steeper increases because they combine scarcity, demand, and visibility.

- Fringe or emerging zones may grow more slowly, especially where infrastructure, roads, or utilities lag.

- Luxury / high-end colonies often outpace mid-tier ones because buyers in that segment are less interest-sensitive.

- Plots vs built units: undeveloped land plots sometimes appreciate more rapidly than finished units because the raw land becomes more speculative as urban sprawl advances.

Table 1 — Expanded Price Trend Insights (2025, Nepal)

| Aspect | Observed Trend / Data | Implication for Colonies / First-Time Buyers |

|---|---|---|

| Official land valuation (KMC) | Rs 5 million per aana in prime roads | Raises baseline for colony plot prices in central zones |

| Real estate price inflation vs CPI | 15–25% vs 6–8% inflation | Colonies must deliver value to justify premium over general inflation. |

| Construction material inflation | ~4.08% YoY; non-metal minerals +16.73% | Increases build cost; developers will pass on to buyers. |

| Demand shift | Increased demand for high-end & luxury units in cities | Puts upward pressure on colonies offering premium amenities. |

| Market caution | Some slowdown in transaction volume due to rates/liquidity | Buyers may negotiate more, developers may offer incentives. |

Interpreting These Trends for First-Time Buyers

With these data in hand, what conclusions or cautions should first-time buyers draw?

- Expect higher baseline costs. Because land values and build costs are rising, entry-level colony units in decent locations now cost significantly more than similar ones 3–5 years ago.

- Lock in early. If you’re considering a colony project, starting when the project is in launch phase may help you capture lower baseline prices before further inflation.

- Look for value in amenities and infrastructure. Colonies with better infrastructure, road access, utilities, and community amenities tend to have better resilience and justify higher prices.

- Stress-test affordability. Because future price increases and interest rate hikes are likely, don’t over-leverage. Build buffer into your budget for cost escalations.

- Selective location choice matters. Colonies in prime or well-connected zones will inflate faster but also maintain desirability and resale value. Fringe colonies may offer lower cost but slower growth.

- Higher upfront cost: Plotted colonies and villas often require larger down payments compared to small urban apartments.

- Potential for capital appreciation: If you can afford up-front costs and hold long term, colonies in desirable locations often deliver stronger capital returns.

- Lifestyle trade-offs: You may choose between central apartment convenience with lower garden space or colony living with more space but (sometimes) longer commutes.

Where prices are rising fastest (hotspots)

Based on market signals and portal data for 2025, the hotspots for colony and plotted developments include:

- Lalitpur suburbs (Bhaisepati, Sainbu) — high demand for gated villas/colonies with green space. Karyabinayak Homes is an example of a villa/colony project in this band commanding premium pricing.

- Kathmandu central corridors (New Road, Durbar Marg surroundings) — official land valuations and limited availability make central colonies rare and expensive.

- Emerging satellite towns (Baneshwor, Koteshwor peripheries, parts of Pokhara) — growing demand for well-planned colonies as commuters look for value and space.

Why colony projects often outpace general housing inflation

Colony projects bundle several value drivers that push prices higher than average standalone houses:

- Planned amenities (clubhouses, pools, community halls) add perceived value and recurring lifestyle benefits.

- Low density & green space are scarce in cities; colonies that guarantee open spaces command premiums.

- Security & gated living attract families and NRNs who prioritize privacy — increasing demand in a limited supply segment.

- Developer branding & payment plans can create immediate demand during launch phases, pushing first-phase prices up quickly.

These combined factors mean colonies can appreciate faster in the short-to-medium term, but they also carry higher absolute price tags at launch.

Financing, interest rates, and their role in colony inflation

Property price inflation is tightly coupled with access to credit:

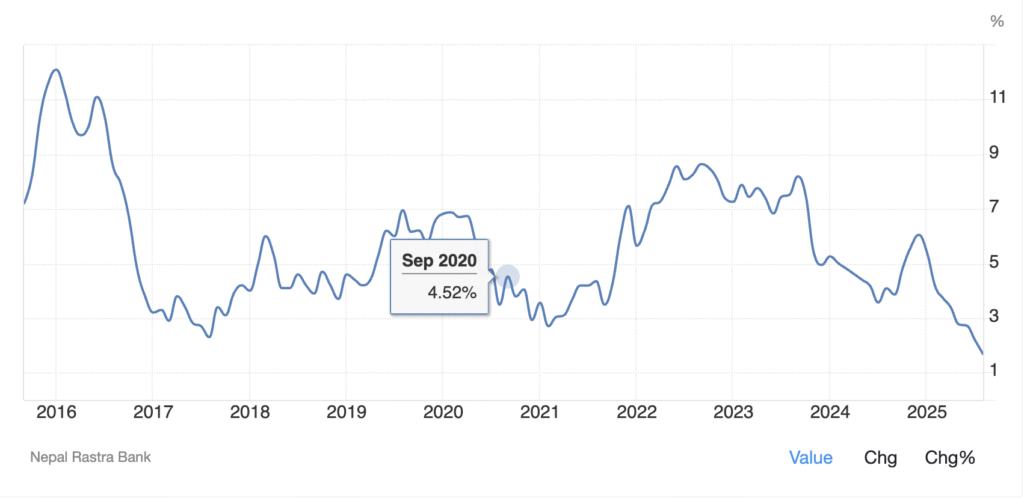

- Lower interest rates expand buyer pool when banks lower home-loan rates or offer flexible EMIs, more buyers enter the market, pushing demand and prices up. Conversely, rate hikes cool buying.

- Developer payment plans (30% down, financed balance, or company-backed EMI deferrals) can shift buyer ability to buy colonies they otherwise could not. Many colony developers offer flexible payment options to capture buyers during launch windows.

Therefore, first-time buyers should always test scenarios where rates rise by 1–2 percentage points to understand sensitivity.

Risk factors and downside scenarios

Despite the recent upward trend, colony investments are not risk-free. Key risks:

- Policy shocks: Changes in land valuation, taxes, or building approvals can quickly alter profitability and buyer demand. The KMC rate change in 2025 is a reminder that official valuations influence market reality.

- Liquidity & resale: Low-density colony units (villas) are less liquid than centrally located apartments resale can take longer.

- Macro slowdown: Slower GDP growth or remittance falls would reduce investor demand and could pressure prices.

What first-time buyers should do — an action plan

- Do the math: Build an ownership budget that includes down payment, EMI, maintenance, taxes, and a 6–12 month emergency buffer.

- Choose micro-location carefully: Convenience (schools, hospitals, commute) will shape resale demand.

- Get pre-approved: Know your EMI limit and get a pre-approval to negotiate smarter.

- Check developer track record: Ask for previous handovers, quality certifications, and references.

- Inspect legal docs: Lalpurja, building permit, environmental clearance, and developer agreements.

- Negotiate payment terms: See if the developer offers staged payments, early-bird discounts, or EMI holiday options.

Table 2 — Quick buyer checklist (before booking)

| Step | What to check |

|---|---|

| Budget | EMI + maintenance + contingency affordability |

| Legal | Lalpurja, approvals, clear title |

| Developer | Past projects, delivery record |

| Location | Schools, hospitals, commute time |

| Amenities | What’s promised vs delivered |

| Exit plan | Resale demand & timeline |

Karyabinayak Homes — why it’s an attractive colony investment

Karyabinayak Homes is a notable example of a colony/villa project highlighted in the market in 2025. With Phase II villas priced from around NPR 3.69 crore and designed as low-density, amenity-rich living, it typifies the current colony market dynamics.

Why Karyabinayak Homes stands out

- Low density & premium finishes: Villas built on 3.5 aana plots with high-end finishes and private amenities attract buyers who want privacy and long-term appreciation.

- Developer payment plans: The project offers staged payment options and bank financing tie-ups that make the high headline price more manageable for certain buyer segments.

- Lifestyle amenities: Clubhouse, pool, gym, landscaped greens, and community facilities create a lifestyle premium that supports higher price points and resale demand.

- Location advantage: Lalitpur suburb locations (such as Bhaisepati/Sainbu) combine scenic value, relative tranquility, and improving connectivity attractive to families and NRNs.

Is it better to invest there? Practical view

- For capital appreciation: Karyabinayak’s low-density model, premium positioning, and limited supply give it potential for steady appreciation if demand for gated villa projects remains strong.

- For rental income: Villas are not always highest yield for monthly rent, but they perform well for holiday rentals, NRN stays, or premium long-term tenancy.

- For long-term homeowners: If you’re looking at legacy, privacy, and space, the project is a compelling choice compared to cramped central apartments.

Note: Higher entry cost and liquidity profile mean it’s best for buyers with strong cashflow or those planning long-term holdings.

Future outlook — what to expect through 2026

- Continued demand for well-designed colonies: Lifestyle demand (green space, security) remains strong, especially among mid- to high-income buyers and NRNs.

- Policy watch: Official land valuation updates and implementing regulations could keep headline prices sensitive to policy shifts.

- Affordability pressure: Unless mortgage access improves substantially or supply expands meaningfully, first-time buyers could face higher entry barriers.

Final words: balancing pragmatism and aspiration

Colony property inflation in 2025 is a fact of Nepal’s urban landscape. For first-time buyers, the key is to balance aspiration with financial realism: colonies offer space, amenities and long-term upside, but they also demand larger capital and longer holding horizons than many central apartments.

If you are a first-time buyer, ask yourself: Do I want space and lifestyle now, or do I prefer a lower monthly commitment and more flexibility? Your answer will guide whether a colony purchase is right — and if so, which location and developer to choose.

Read More: New Colony in Bhaisepati: Karyabinayak Homes Redefining Luxury Living in Lalitpur