Purchasing property is one of the biggest financial decisions you’ll ever make. However, the process is often clouded by myths and misconceptions, especially in Nepal’s unique real estate landscape. Let’s debunk some of the most common myths about buying property in Nepal and help you make informed decisions.

Myth 1: You Need to Be Wealthy to Invest in Real Estate

One common misconception is that property investment is only for the wealthy. While it’s true that property requires a significant financial commitment, options like home loans and installment payment plans make real estate accessible to a wider audience.

How to Avoid Falling for This Myth:

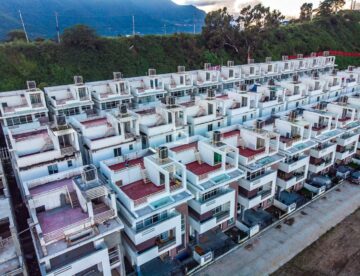

Research affordable housing projects or off-plan properties that offer flexible payment options. For example, developments like Abhra Villas provide luxury homes with competitive financing plans.

Myth 2: Property Prices Always Go Up

Many believe that property prices in Nepal only appreciate over time. While the long-term trend is positive due to urbanization and demand, real estate markets can fluctuate. Political instability, overvalued land, or changes in zoning laws can impact property value.

How to Avoid Falling for This Myth:

Analyze market trends before making an investment. Focus on areas with growing infrastructure, such as Bhaisepati or Gyaneshwor, to ensure better long-term value.

Myth 3: Foreigners Cannot Buy Property in Nepal

It’s a widespread belief that non-Nepalese citizens are entirely prohibited from buying property in Nepal. While it’s true that there are restrictions, there are ways for foreigners to invest indirectly, such as through partnerships with Nepali citizens or corporate entities.

How to Avoid Falling for This Myth:

Seek advice from real estate lawyers who specialize in foreign investments in Nepal. Understanding legal frameworks can open new opportunities for property investment.

Myth 4: Buying Property is Too Risky

Some believe real estate is a high-risk investment due to scams or unclear ownership titles. While risks exist, they can be mitigated with due diligence.

How to Avoid Falling for This Myth:

- Verify property documents with a lawyer.

- Conduct a land valuation and market analysis.

- Work with reputable real estate companies like Karyabinayak Homes that ensure transparency.

Myth 5: You Must Pay the Full Amount Upfront

Another common myth is that you need to have the entire property cost saved up before buying. However, many banks and financial institutions in Nepal offer housing loans with interest rates as low as 9.5%.

How to Avoid Falling for This Myth:

Look into financing options like bank loans or developers’ installment schemes. Calculate your budget and ensure you can meet monthly payments comfortably.

Conclusion: Buying Property in Nepal – Fact vs. Fiction

Understanding the realities of property investment can save you from making costly mistakes. By separating myths from facts, you can navigate Nepal’s real estate market with confidence. Whether you’re considering a family home or an investment property, it’s always best to do thorough research and consult experts.

Continue reading: How to Spot a Good Real Estate Deal in Nepal: Key Indicators for Success