Buying or selling property is one of the biggest financial decisions many people make, especially in Nepal, where real estate has seen rapid growth. Whether you’re a first-time buyer or a seasoned investor, the process can be overwhelming. One crucial aspect that often gets overlooked is property valuation. Getting the right property valuation is essential to ensure you don’t overpay or sell at a loss. This blog will explore why proper property valuation is critical in Nepal and how it impacts your real estate transaction.

Why Property Valuation Matters

Imagine you’re buying your first home in Kathmandu. You’ve found what seems like the perfect house in a prime location. You’re excited, but how do you know if the price is fair? On the flip side, if you’re selling a piece of land or a house, how do you ensure you’re not leaving money on the table?

That’s where property valuation comes in. A professional property valuation ensures that the property’s price reflects its true market value. It considers several factors like location, size, condition, and recent sales in the area. Without this, you might end up paying far more than the property is worth or selling it for less than what you should.

Preventing Overpaying as a Buyer

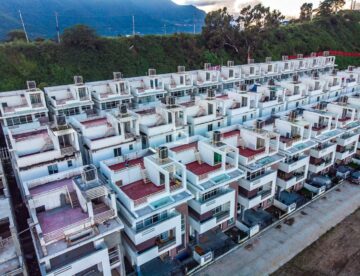

If you’re a buyer, not getting a proper property valuation could mean overpaying. Nepal’s real estate market is competitive, especially in areas like Kathmandu, Pokhara, and Lalitpur. Prices can fluctuate rapidly based on demand, infrastructure development, and even rumors of upcoming projects.

By getting a valuation, you ensure that the asking price aligns with the actual worth of the property. It protects you from paying inflated prices that could be driven by hype or seller expectations rather than market reality.

Consider the story of my friend, Sushil, who was on the verge of buying a house in Bhaktapur last year. The house was beautiful, located near schools and hospitals, and had all the amenities he needed. However, before closing the deal, Sushil decided to get a valuation done. It turned out the seller was asking 20% more than the property’s actual market value. Thanks to the valuation, he saved a significant amount and found a better deal elsewhere.

Ensuring Fair Selling Price

As a seller, you want to get the best price for your property. But how do you know what that price should be? A proper property valuation helps you set a realistic price based on the current market conditions. It takes into account factors like the property’s age, location, condition, and even future development in the area.

For instance, suppose you’re selling land in Lalitpur. The area has seen massive infrastructure development, including new roads and shopping centers, which have increased property prices. A proper valuation will ensure that you price your land accordingly, maximizing your profit.

Without a valuation, you might underprice your property, leading to a quick sale but leaving you with less money than you deserve. Or worse, you might overprice it, resulting in the property sitting on the market for too long, which can make it less attractive to buyers.

Building Trust in Negotiations

When both the buyer and seller have access to a proper property valuation, it creates a foundation of trust in the negotiation process. Buyers feel confident they aren’t being overcharged, and sellers know they’re getting a fair deal. Valuation reports also provide an objective, third-party assessment of the property’s value, which can be particularly useful in cases where disputes arise over pricing.

Take for example, someone selling an apartment in Nakkhu. Without proper valuation, the seller might ask for a price based on what neighboring properties sold for or even emotional attachment to the home. The buyer, on the other hand, might think the asking price is too high. A valuation helps both sides meet on common ground, making negotiations smoother and less stressful.

Boosting Loan and Investment Confidence

Many property buyers in Nepal rely on loans to finance their purchase. Banks and financial institutions require a property valuation before approving a loan. They need to ensure the property is worth the amount being borrowed. If the valuation is not done correctly, buyers may face difficulties securing a loan, or worse, get a loan that is less than what they need.

Similarly, investors looking to buy properties for rental income or resale need an accurate valuation to make informed decisions. Investing without knowing a property’s true value could lead to financial losses down the road.

Whether you’re buying or selling property in Nepal, proper property valuation is a critical step that shouldn’t be skipped. It ensures you get a fair price, builds trust during negotiations, and helps with loan approvals. Real estate is a significant investment, and taking the time to understand the actual value of a property can save you money and stress in the long run. If you’re entering the market, make sure to get a professional valuation—it’s a small step that can have a big impact.

Recommended reading: Challenges and Considerations in Kathmandu’s Real Estate Market